By Brian Wagner, PTIS Founder & Principal

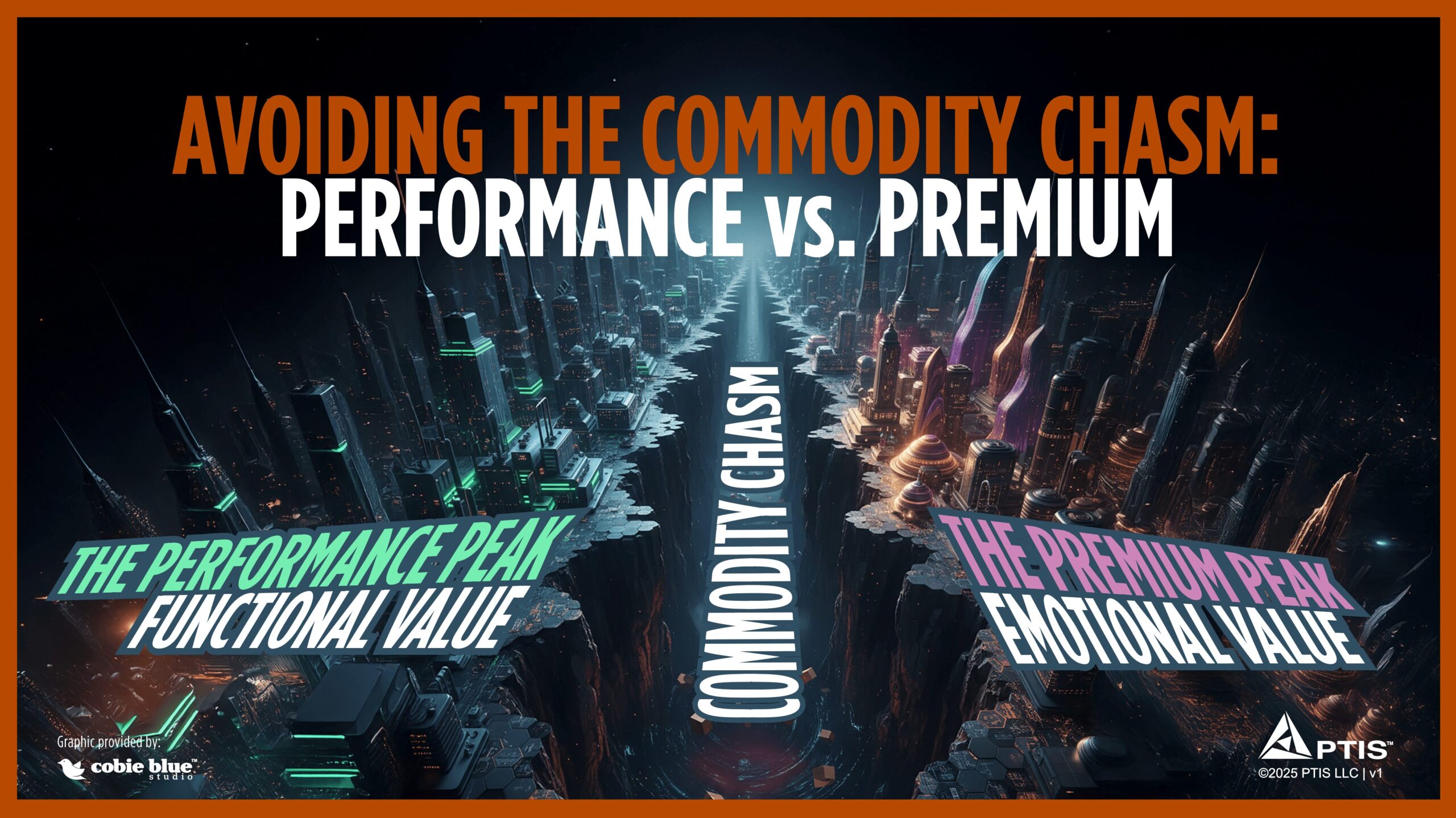

“Consumer choices aren’t clustering around ‘average’ anymore; they are bifurcating into ‘good enough’ efficiency and premium personal value. The middle? A commoditized chasm where price wars devour margins.”

Packaging at a Crossroads

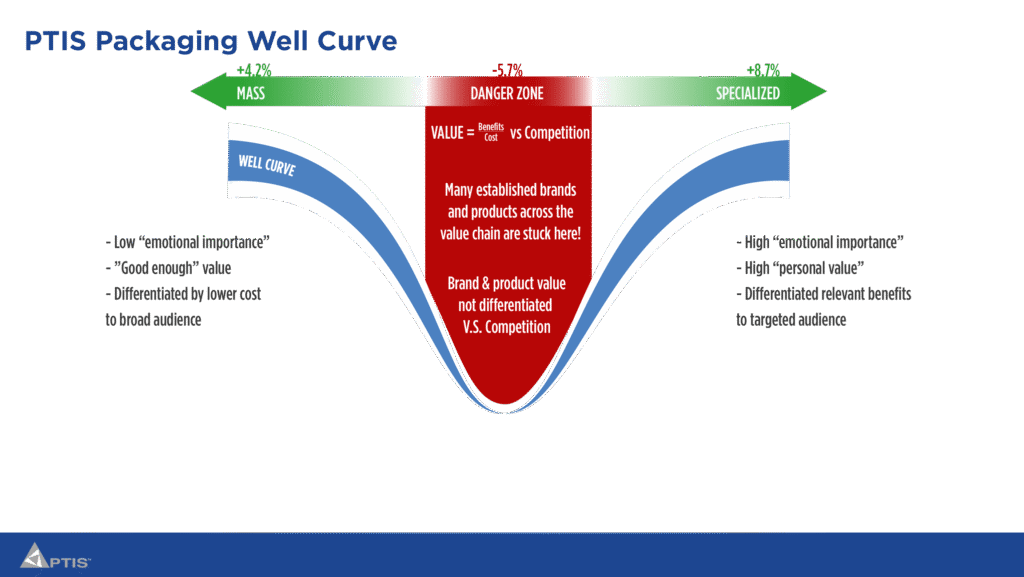

As we close out 2025, the packaging industry stands at a crossroads of unprecedented disruption—AI-driven supply chains, EPR mandates sweeping Europe and North America, and Gen Z’s unyielding demand for transparency. Yet amid this flux, one framework has quietly guided innovators for over two decades: the PTIS Packaging Well Curve. Discovered by our team in 2003, mere months after automation visionary Jim Pinto’s seminal San Diego Mensan article popularized the “bi-modal” shift in consumer behavior, this inverted bell curve has become our North Star for value creation. Today, as McKinsey’s 2025 consumer surveys echo its predictions, it’s clear: the Well Curve isn’t just prescient—it’s essential for thriving in the decade ahead.

PTIS Packaging Well Curve

Flash back to May 2003. Daniel Pink’s Wired piece “The Shape of Things to Come” had just ignited a firestorm, declaring that societal distributions were morphing from tidy bells to dramatic “wells”—extremes dominating, middles evaporating. Pinto, building on this, framed it as economic polarization: mass-market behemoths versus niche artisans, with mid-tier players squeezed into oblivion. At PTIS—co-founded by Dr. Michael Richmond and myself in 2000—we saw immediate parallels in packaging. Consumer choices weren’t clustering around “average” anymore; they were bifurcating into “good enough” efficiency (left peak: functional, low-cost, reliable) and “premium personal value” (right peak: experiential, aspirational, emotionally resonant). The middle? A commoditized chasm where price wars devoured margins.

We dubbed it the PTIS Packaging Well Curve and put it to work that summer, auditing a major CPG client’s portfolio. What emerged was revelatory: a significant portion of their SKUs languished in the undifferentiated dip, yielding thin returns despite heavy marketing spend. By exploring migrations to the left (streamlined recyclables for cost efficiency) and right (bespoke unboxings for enhanced loyalty), we helped identify pathways to improved profitability. That was 2003—no AI, no blockchain, just sharp foresight and our core equation: Value = (Real + Perceived Benefits) / (Price or Cost vs. Competition), assessed across the lifecycle from sensation transference at shelf to guilt-free disposal.

Understanding the Well Curve

Over 22 years, we’ve applied this lens to dozens of clients across the value chain, from startups to Fortune 50s. In household goods, it helped a detergent giant consider polarization: left-side mono-material pouches for routine replenishment, right-side scented, AR-enabled refills for “treat” occasions. In beauty, a skincare brand escaped the middle by infusing purpose-driven narratives—sustainable narratives on premium packs aligned with BAV Esteem metrics, per Young & Rubicam’s framework. We’ve weathered recessions, pandemics, and e-commerce booms, always emphasizing emotional drivers: 80–95% of decisions subconscious, per Zaltman’s canon. Neuromarketing proxies like eye-tracking and IATs confirmed it—left evokes trust’s quiet relief, right sparks aspirational joy.

Now, in 2025, the establishment is catching up. McKinsey’s June global survey of 11,000 consumers across 11 countries paints a stark picture: environmental impact ranks sixth in purchase drivers, trailing price (top-ranked, up 5% since 2023), convenience, and shelf life. Yet willingness to pay “a lot more” for sustainability hovers at just 10–15% globally, with India at 36% and Japan at 3%—classic polarization. Their data mirrors the Well Curve: post-inflation destocking and geopolitical jitters have hollowed the middle further, with consumers flocking to ultra-efficient basics or indulgent premiums. As McKinsey notes, ESG-claimed products grew 28% cumulatively pre-2025, versus 20% for others—proof that extremes win. Packaging World has chronicled this too: our own 2025 “Looking Back to Look Forward” piece highlighted geopolitical tensions and AI as accelerators of bi-modal shifts, urging converters to prepare for supply chain fractures.

Future-Proofing with the Well Curve

Looking ahead to 2035, the PTIS Packaging Well Curve will be indispensable for CPGs, retailers, and manufacturers navigating a $500 billion market ballooning at 5% CAGR. For CPG brand owners, it demands portfolio ruthlessness: cull the middle (projected 20% erosion by 2030) and double down on extremes. Left-side innovations like lightweight, PCR-heavy mailers will capture 40% of routine e-comm volume, slashing costs 25% amid EPR fees. Right-side experiential packs—think NFC-enabled, personalized unboxings—could drive 30–50% willingness-to-pay uplifts, per McKinsey’s Gen Z insights, fueling premiumization in a $100B DTC segment. We’ve guided clients in benchmarking via BAV proxies and low-cost surveys, ensuring emotional resonance without fMRI budgets.

Retailers, facing private-label surges (now 30%+ globally), gain a negotiation superpower: the Curve quantifies shelf space value. Polarized own-brands—left for price-beating efficiency (4–9 point margin gains), right for “retail theater” (8–18% category lifts, à la Costco editions)—will fortify loyalty amid 15–25% logistics savings from damage-proof designs.

Embrace the Extremes

Packaging manufacturers, long commoditized, flip the script: sell “value per thousand” via Curve-aligned structures. Left-side mono-materials secure scale (3–5x win rates on volume bids), while right-side smart finishes command 25–80% premiums, locking in multi-year deals. As AI fractures supply chains, the Curve’s foresight—via our Future of Packaging™ scenarios—ensures resilience, turning polarization into profit.

In 2003, the Well Curve was a hunch; today, it’s proven. At PTIS, Dr. Richmond and I built it to create “net positive” impact. Over the next decade, it will redefine winners: those who embrace extremes, not averages. Let’s curve the future—together. Schedule a call with PTIS.